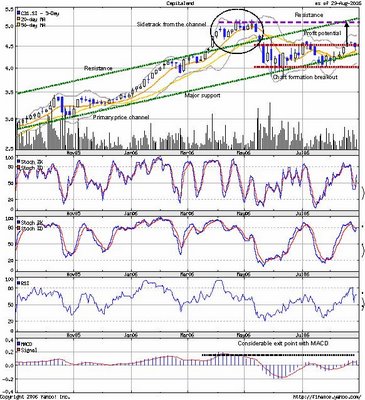

Okay, some of you may think im crazy to hop on to this counter when the indicators are warning me to stay out at their current level. Even though that is the case, there is still a inclination that the indicators, take for example the slow stochcastics, may hover around the overbought region for a couple of weeks. The advancement today is actually well beyond the previous resistance level, where weeks ago the price was contained in a relatively small double bottom chart formation. Looking at it, the counter may be in position for further increases with profit potential from the breakout at around $5 of the underlying. A noteworthy exit point would be when MACD touches my presumed take profit level.

Okay, some of you may think im crazy to hop on to this counter when the indicators are warning me to stay out at their current level. Even though that is the case, there is still a inclination that the indicators, take for example the slow stochcastics, may hover around the overbought region for a couple of weeks. The advancement today is actually well beyond the previous resistance level, where weeks ago the price was contained in a relatively small double bottom chart formation. Looking at it, the counter may be in position for further increases with profit potential from the breakout at around $5 of the underlying. A noteworthy exit point would be when MACD touches my presumed take profit level.

Visual investing on nikkei and hsi

Nikkei, deal , wheel or steal

Warrant strategy? analysis assessment

Thursday, August 31, 2006

Capitaland, blending with the herd

Posted by

the street analyst

at

8/31/2006 02:07:00 AM

![]()

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment