14-Aug-2006

Despite the fact that indexs warrants speculation has been in the buzz amongst local traders lately, i doubt this fever will carry on forward into the coming months. But anyway, on this very day, the Nikkei jumped 1.45% from its original level of 15,550.96 to 15,790.82 mainly due to growing optimism of the domestic economy coupled with accelarated short-term buying.

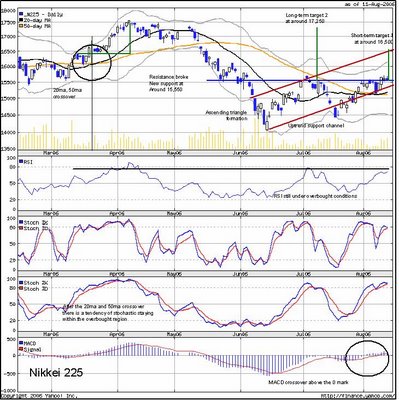

Based on the above technical chart, my forecast would be that the index may climb up to reach my 1st target level of 16,500.00. With the cease-fire in the mid-east region, coupled with oil price correction, general investing sentiment looks fine. However, an issue worthy to note is with regards to the outlook for future federal reserve rates hike. If everything has been taken care of, jeopardizing my standpoint of going long is highly unlikely. Anyway, i'm still not 100% certain of whether to execute this partiular trade or not. Afterall it will be highly dependable on whether the RSI breaks the overbought limit. Just to inform, the above chart is dated 11-Aug-2006 which is kinda outdated. More to come in just a few hours.

Welcome to my World

Check out Nikkei Trade Outcome

My Checklist

Tuesday, August 15, 2006

Trading the Nikkei 225

Posted by

the street analyst

at

8/15/2006 01:58:00 AM

![]()

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment