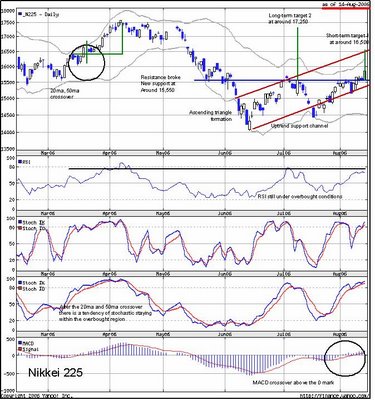

Here i have, the latest chart on the Nikkei 225. Will share with you guys the main keypoints on why i think going long on Nikkei 225 is a trade worthy to be.

- RSI still under overbought conditions may signify that bullish trend will still be intact

- MACD crossover indicating bullish trend most likely taking place

- Ascending triangle formation breakout, giving target level at the 17,500.00 mark

- Based on the fact that the price is somewhere near the lower end of the trend channel, may seem to be a good buy

- If you look closely at the previous incident where the MACD crossover over the zero barrier, you will see that almost every indicator are in place to now and before. Will history repeat itself?

Needless to say i will be filling in my trade soon by the end of today.

No comments:

Post a Comment