My last update

Paper trading

don't you want to be young and rich? analyzing for profitable trades in the market. the bulls the bears, deciding on buy hold or sell from a youth trader's perspectives. be fearful when others are greedy. be greedy when others are fearful. Can a 20-YEAR-OLD TRADER beat the market?

Posted by

the street analyst

at

4/01/2008 09:06:00 PM

0

comments

![]()

Posted by

the street analyst

at

4/01/2007 08:58:00 PM

0

comments

![]()

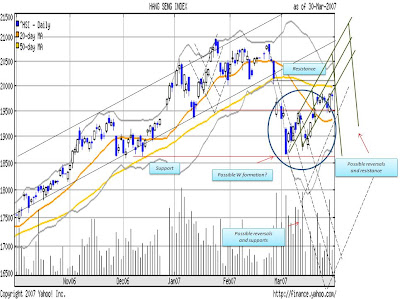

Market action this week has made light of the once possible W formation as the STI advances breaking out from the resistance. However, recently the surge in the index is based on what i would see as weak volume. Caution has to be taken as one trades in such volatile markets where the most unexpected always happen. I feel that there is still room for the STI to move up, but i also strongly believe that a major correction or perhaps the start of the bear market is near. On a short-term note, it will still be safe to speculate on call warrants with the STI showing signs of bullishness. A temporary one maybe. Still and again, please be careful. Happy trading! :)

Market action this week has made light of the once possible W formation as the STI advances breaking out from the resistance. However, recently the surge in the index is based on what i would see as weak volume. Caution has to be taken as one trades in such volatile markets where the most unexpected always happen. I feel that there is still room for the STI to move up, but i also strongly believe that a major correction or perhaps the start of the bear market is near. On a short-term note, it will still be safe to speculate on call warrants with the STI showing signs of bullishness. A temporary one maybe. Still and again, please be careful. Happy trading! :)

Posted by

the street analyst

at

3/24/2007 07:43:00 PM

0

comments

![]()

Below are a few recommendations on the warrants i deem best.

If you are bull, below:

DBSDBECW070618 0.09

NIKKEI225DBECW070611B 0.12

OCBCSGAECW0707069 0.13

SCMRBECW070528 0.085

SPCSGAECW070528 0.11

UOBDBECW07016 0.14

UOBMBLECW070906 0.15

If you are bear, here's how:

DBSBNPEPW070910 - 0.09

OCBCDBEPW070716 - 0.13

SGX?

Bull market still?

Update on warrant portfolio

Posted by

the street analyst

at

3/18/2007 10:13:00 PM

0

comments

![]()

I'm back! Not to fret, I’m doing fine in warrants trading, and would like to share with you guys my recommendations on what to buy and perhaps what should be avoided. The general market sentiment now is rather difficult to gauge and stands on a 50-50 probability of it going either way. It will take time to see which side will emerge as the ultimate winner of this financial battlefield. For conservative traders, you may want to adopt a "wait and see" approach. As for the aggressive ones, below are the suggestions on what I deem hot in the near future. To stick with the current bull or to hop on to the "emerging" bear, you decide.

If you are still bullish, you may consider these warrants:

DBSDBECW070618 0.095

MPLRBECW071212 0.125

NIKKEI225DBECW070611B 0.16

OCBCSGAECW070709 0.165

SEMBCORPINDUSSGAECW070820 0.12

SCMRBECW070528 0.09

SINGTELDBECW070625 0.15

SPCSGAECW070528 0.13

UOBDBECW070716 0.155

UOBMBLECW070906 0.18

If your stand is bearish, here's how:

DBSBNPEPW070910 0.085

OCBCDBEPW070716 0.12

Posted by

the street analyst

at

10/03/2006 11:00:00 AM

0

comments

![]()