I would say by going into a call warrant at this point of time MAY be too much of a risk. Here’s why:

- Bourses like the Dow, Nikkei, and perhaps the STI are finding some resistance to add on further gains. Furthermore, these indices are pretty much at a pressured overbought region, and I’ll be concerned over the extent of damage this counter will suffer along with these key indices if in any event that they are heading south. Recently there has been much concern over the US economic future and interest rates and all, and so this negative news may exacerbate on the declines. In effect, may bring our leveraged position on the call warrants down as well.

- SGX has been one of the most outstanding performers within the STI components and finds its place in the top 2 deciles most of the time. Drawdown is to a minimal excluding the past few months where the Fed rate is much of a worry.

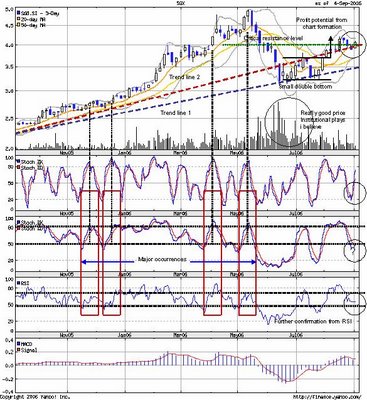

- Profit potential from the small double bottom top breakout at around $4.20.

- Major occurrences with relates to slow stochastic getting back from its mark marginally below 50.

- If general investing sentiment is alright, upside possibility is tremendous.

Warrant strategy?analysis assessment

Blog revived

What to do?

No comments:

Post a Comment