Around 1.20% were taken away from the HSI as well as the Nikkei with the reaction brought forth from action on Wall Street in yesterday's trading. This was due to weak housing numbers and also inflationary fears that may hike up interest rate to 5.50%.

Around 1.20% were taken away from the HSI as well as the Nikkei with the reaction brought forth from action on Wall Street in yesterday's trading. This was due to weak housing numbers and also inflationary fears that may hike up interest rate to 5.50%.

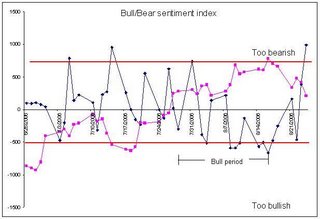

For the past month, we have been experiencing a kind of bullish episode in this interest rate hikes saga. As for now, our forecast and analysis were spot on when we saw that the HSI has already topped and may eventually plunge. Therefore, so as to say, will the bears continue to hammer the bulls in the weeks to come?

Ever since we filled in our put contracts, we have gained almost 24%. With the market moving cautiously towards 20th September, its very difficult to settle on whether our trade will remain profitable in the long run.

Be vigilant and not reckless. Do not be contained by your emotions of fear that the market may recover soon following the plunges. Be certain and confident of your perceived direction. We may well see the trend developing after today's activities on Wall Street.

Warrants standings

offically 20 year old trader!

SGX stock whiz competition

Thursday, August 24, 2006

Overbearishness clouding the HSI?

Posted by

the street analyst

at

8/24/2006 08:56:00 PM

![]()

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment